REGIME 40 IN FRANCE:

Everything Importers and Exporters Need to Know

What We’ll Cover in This Blog

What Is Regime 40 in France?

Regime 40 (customs procedure code 40 00) is the procedure for the release for free circulation of non-Union goods in the European Union. Under this regime, goods are cleared for the EU market, and customs duties and import VAT are paid in the Member State of import. For example, in France when it is the first EU country of entry.

Once cleared under Regime 40, the goods obtain Union status, meaning they can move freely within the EU without further customs formalities.

This regime is used for permanent imports and differs from procedures like temporary admission, which allows goods to enter the EU temporarily without paying duties or VAT.

How Regime 40 Works for Importers and Exporters

When importing goods into France under Regime 40, businesses must:

- Declare goods to French customs using the appropriate customs code (40 00)

- Submit supporting documentation, including the commercial invoice, transport documents, and any required certificates or licenses

- Pay customs duties and import VAT calculated on the customs value of the goods

- After clearance, the goods can circulate freely throughout the EU

This regime is commonly used when France serves as the entry point for goods entering the EU market. If goods are later delivered to another EU country, companies must also comply with intra-EU VAT and delivery requirements.

Benefits of Using Regime 40

For importers and exporters trading with France, Regime 40 provides several operational advantages:

- Free circulation within the EU after customs clearance

- Simplified logistics, especially when France is the port of entry for wider EU trade

- Centralized payment of duties and VAT in one member state

- Once goods are in free circulation, no further import formalities are required for movement within the EU, although VAT and regulatory obligations still apply.

Compliance and Reporting Obligations

Accurate customs declarations are essential when using Regime 40. Importers should:

- Ensure the customs value and commodity codes are correctly declared

- Keep all import documents (invoice, packing list, transport records, and customs declaration) for audit purposes

- Pay duties and VAT on time to secure free circulation status

- Confirm that goods meet EU regulatory and conformity requirements, such as CE marking when applicable

While customs clearance allows goods to circulate freely, importers remain responsible for ensuring products meet EU safety, labelling, and compliance standards.

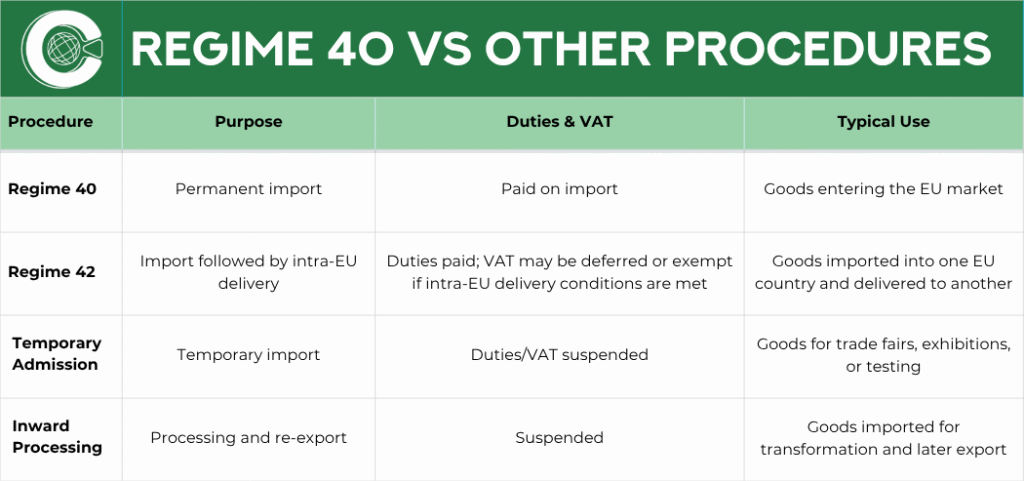

Regime 40 vs Other Customs Procedures

To avoid confusion, here’s how Regime 40 compares to other common customs regimes:

Practical Tips for Companies Importing into France

To manage imports efficiently under Regime 40:

1. Plan customs clearance early and confirm the correct procedure code

2. Work with a licensed customs representative to handle declarations accurately

3. Ensure suppliers provide compliant invoices and origin documentation

4. Track imports through your customs and accounting systems to manage VAT recovery

Proper planning and coordination with customs professionals help businesses avoid errors and benefit from smooth clearance and EU-wide circulation.

At Customs Complete, we support your company importing into France and across the EU with accurate declarations, customs compliance, and efficient clearance under Regime 40.

Contact us using the form below.